Charging Interest

by Andrew Boyd

Today, interest. The University of Houston's College of Engineering presents this series about the machines that make our civilization run, and the people whose ingenuity created them.

Loaning money is a cornerstone of modern economies. Of course, to secure a loan, we have to agree to pay back the lender — with interest. But is it fair to charge interest?

It seems almost silly to ask since we do it so routinely. But it's a question that's confounded politicians, scholars, and merchants for as long as money's been around.

Throughout history, religious scholars from many traditions denounced payment of interest as depraved. Sixteenth century Pope Sixtus V condemned interest as "detestable to God and man, damned by the sacred canons and contrary to Christian charity." As late as 1745, Benedict XIV released a papal encyclical condemning interest as "sin."

Christian theologians weren't alone in their beliefs. Jewish scholars needed only look to the Torah for guidance. In the book of Deuteronomy we find "Thou shalt not lend [with] interest to thy brother …" And from Leviticus, "… if thy brother be waxen poor … take thou no interest of him; but fear thy God …" The Islamic Qur'an also rebukes the practice of charging interest. "God condemns interest," we're told. "Those who charge [it] are in the same position as those controlled by the devil's influence." Even today, Islamic financial transactions are often structured to altogether avoid loans with interest — riba in Arabic.

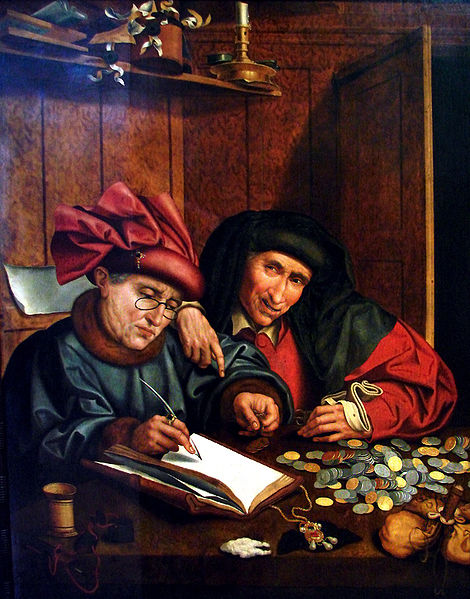

Why such disdain for what we now consider a common practice? There were many reasons, not the least of which was that the poor tended to suffer at the hands of the wealthy. But perhaps the biggest reason was that lenders didn't labor to produce anything — something considered a moral necessity to get paid. A baker labored to produce bread from grain. A stonemason labored to shape stones for building. Both deserved payment for their efforts. A lender, on the other hand, merely handed out money. Why should he receive recompense when he didn't make anything?

In a world where value is measured by physical labor, there's a strong moral argument that he shouldn't. But should value be measured by physical labor alone?

The answer was no according to prominent thinkers of the Enlightenment. Interest represented payment for risk — risk that the lender might not get his money back. As the role of interest was more fully accepted, it in turn encouraged investment. Investment to open factories. Investment to build ports. With loans we can buy a car, a house, or send our children to college. Without loans, that would be difficult or even impossible. It would certainly have seemed an enigma to early religious scholars, but interest is one of the fundamental engines of our economy.

I'm Andy Boyd at the University of Houston, where we're interested in the way inventive minds work.

For a related episode, see THE JUST PRICE.

W. A. M. Visser and A. McIntosh. 1998. "A Short Review of the Historical Critique of Usury." Accounting, Business & Financial History 8(2): 175-189.

Usury. From the Wikipedia web site: https://en.wikipedia.org/wiki/Usury#cite_note-m7-3. Accessed October 6, 2009.

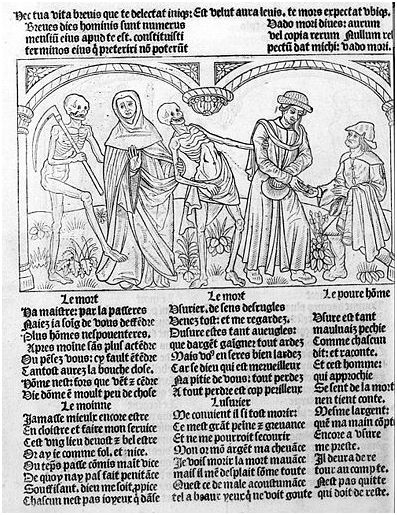

All pictures are from Wikimedia Commons. The book page is from the publication La Danse Macabre, Paris: Guy Marchant, 1486.