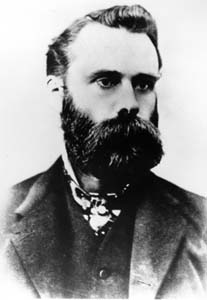

Charles Dow

by Roger Kaza

Today, an "average" guy. The University of Houston's Music School presents this program about the machines that make our civilization run, and the people whose ingenuity created them.

The Dow is up. The Dow is down. Chances are that part of you rises and falls a little right along with it. That's okay — very few fluctuations in life are so comfortingly black and white — I mean — red. The Dow Jones Industrial Average has been around since 1896, and the first thing to know is that it's two names, not one: Charles Henry Dow and Edward Davis Jones. The two journalists started a small financial news service along with another partner, Charles Bergstresser. Bergstresser was the one with the deep pockets to bankroll the new company, but was unfortunately cursed with a name too long for the letterhead. So Dow Jones it became.

Charles Dow's roots were far from the world of high finance. He was born on a farm in Connecticut in 1851. He dropped out of high school with a single burning desire: to be a reporter. His sheer moxie made an impression, and the Providence Journal sent him on a train trip to Leadville, Colorado, heart of the Rocky mountain silver industry. Leadville was a boomtown; millionaires were born in a day. Oscar Wilde lectured at the opera house. The young Dow cavorted with tycoons and moguls, and the trip taught him everything he needed to know about finance.

Charles Dow's roots were far from the world of high finance. He was born on a farm in Connecticut in 1851. He dropped out of high school with a single burning desire: to be a reporter. His sheer moxie made an impression, and the Providence Journal sent him on a train trip to Leadville, Colorado, heart of the Rocky mountain silver industry. Leadville was a boomtown; millionaires were born in a day. Oscar Wilde lectured at the opera house. The young Dow cavorted with tycoons and moguls, and the trip taught him everything he needed to know about finance.

Sensible investing didn't always mean stocks; then, it meant bonds. Machinery and factories backed up bonds, and bonds paid a dividend. In contrast, common stocks gave you part ownership of a company, but inside information about a company's finances was strictly hush-hush. Any published "news" probably meant that the reporter was a new shareholder. Objective information was in short supply, and Dow set out to change that. His company's "Customers' Afternoon Letter" — which later became the Wall Street Journal — published stock tables, quarterly and annual reports. It gave the lay public half a chance at making informed investments.

Dow started his indices with railroad stocks. Then, in 1896 he published the first index of the so-called "smokestack" companies, the original Dow Dozen. It's a window into 19th century industrial America, and you can practically smell those smokestacks: American Tobacco, U.S. Leather, Tennessee Coal and Iron. Of the 12, almost all of them produced things: lead, cotton, sugar, rubber. The two exceptions were as novel and forward-looking then as the Internet was a century later: North American Edison Company, and General Electric Corporation. GE is the only company from the original 12 still in the Dow.

A logarithmic graph of the Dow, 1896-present

The first Dow average was literally that. He added up the 12 stock prices, and divided by 12. It started at — are you ready? — 41. Today's index is calculated in a similar way. It contains only 30 large blue-chip companies — less than 1% of the 2800 or so stocks listed on the New York Stock Exchange and NASDAQ. So Dow's barometer of our economic weather is a small one — but, the one to which our eyes always seem to turn.

Well, it's been 3-1/2 minutes now. Shall we check again?

I'm Roger Kaza at the University of Houston, where we're interested in the way inventive minds work.

Edward Davis Jones is barely mentioned in the above article, because, although he was a co-founder of the company that bears his name, he apparently had nothing to with the Dow Jones Industrial Average. Nor is he to be confused with the Edward D. Jones who founded the ubiquitous investment services.

The original Dow 12, and what became of each company.

| American Cotton Oil Distant ancestor of CPC International | Distant ancestor of CPC International |

| American Sugar | Evolved into Amstar Holdings |

| American Tobacco | Broken up in 1911 antitrust action |

| Chicago Gas | Absorbed by Peoples Gas, 1897 |

| Distilling and Cattle Feeding | Whiskey trust evolved into Quantum Chemical |

| General Electric | Still in the DJIA |

| Laclede Gas | Active, removed from DJIA in 1899 |

| National Lead | Today's NL Industries |

| Tennessee Coal & Iron | Absorbed by U.S. Steel in 1907 |

| North American | Utility combine broken up in 1940's |

| U.S. Leather (preferred) | Dissolved in 1952 |

| U.S. Rubber | Became Uniroyal, now part of Michelin |

The starting figure for the Dow was actually $40.94 .

A Wikipedia article which lists the current Dow 30, as well as a calculation formula.

Warren Buffett has noted that in order to repeat the Dow's astonishing returns in its first century (from 41 to almost 10,000, a compounded annual rate of 5.3%) today's Dow would have to rise to 2,000,000 by the year 2100. Any wagers?

Photo courtesy Dow Jones & Company.

Graph courtesy Wikimedia Commons

Dow 12 table based on information found at davidstuff.com

Thanks to David H. Papell, Professor of Economics, University of Houston, for his assistance with this episode.